LitFinancial Launches litUSD Stablecoin on Ethereum to Transform Mortgage Lending

A Landmark in Real Estate Finance

LitFinancial has introduced litUSD, a fully backed stablecoin on Ethereum designed to streamline mortgage lending as reported by CoinDesk. This marks one of the first times blockchain technology is being directly applied to modernize the $12 trillion U.S. mortgage market. By reducing treasury and funding costs while providing instant settlement capabilities, litUSD represents a major milestone in merging traditional housing finance with decentralized technology.

Efficiency and Transparency for the Mortgage Industry

The mortgage market has long been defined by complexity, delays, and high costs. By issuing litUSD directly on Ethereum, LitFinancial is bringing unprecedented efficiency, transparency, and speed to mortgage operations. Borrowers, lenders, and secondary market participants can now access a stable, blockchain-native currency that reduces friction in settlement, enhances reporting clarity, and minimizes operational risk. This is a decisive shift away from outdated rails toward a digital-first, more accountable financial ecosystem.

Pioneering Blockchain Utility in Housing Finance

While stablecoins have historically been used for payments and trading, LitFinancial’s litUSD represents one of the first practical deployments of stablecoins in mortgage finance. This isn’t just an experiment—it’s a live, scalable solution designed to directly lower funding costs and expand liquidity access for lenders. By building on Ethereum, litUSD aligns with global standards for interoperability and positions mortgage lending at the forefront of blockchain adoption.

Setting the Standard for the Future

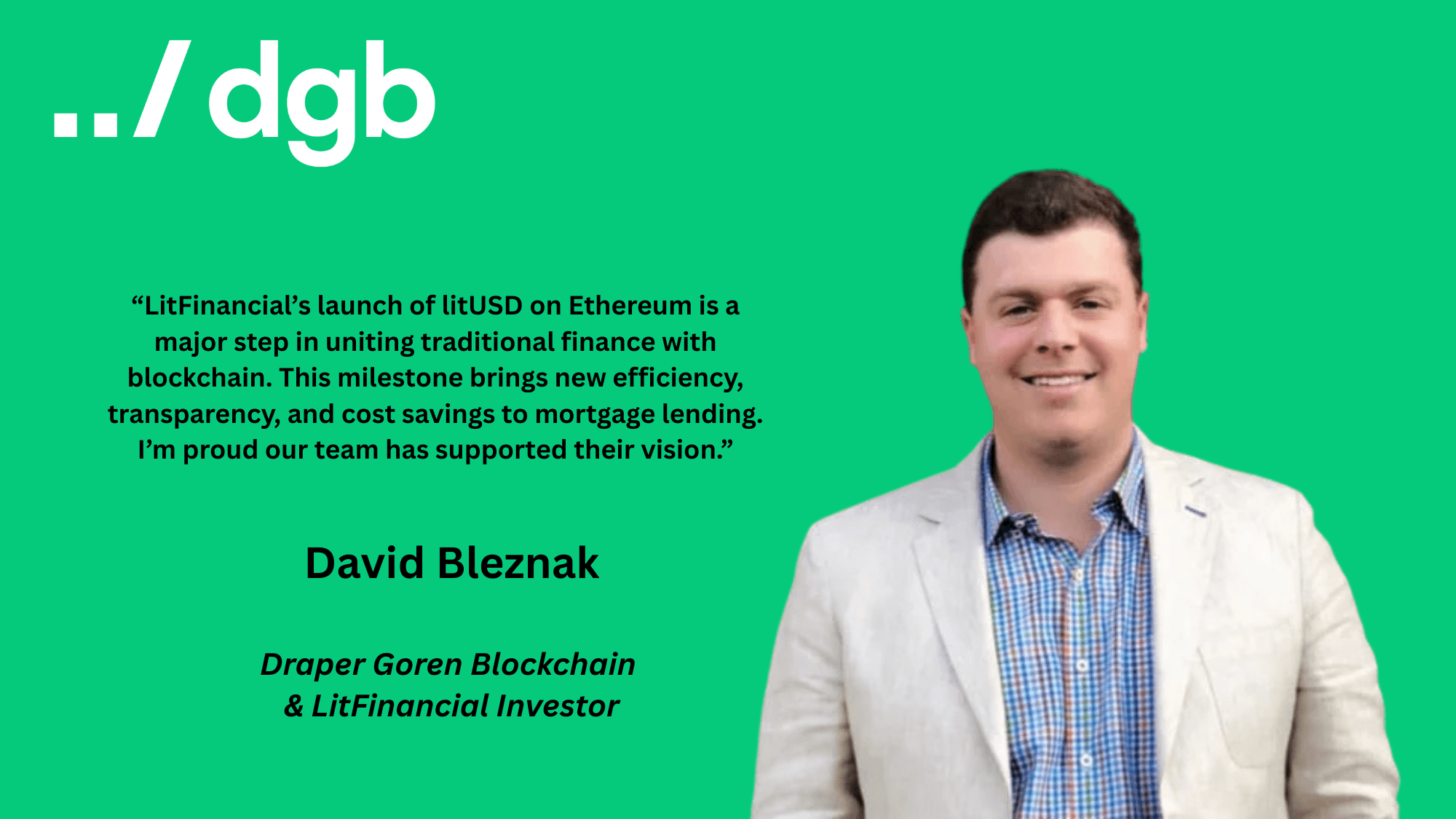

LitFinancial’s launch of litUSD establishes a new benchmark for how blockchain can power real-world financial applications. This achievement demonstrates that mortgage finance can evolve to become faster, safer, and more inclusive—all while maintaining institutional-grade reliability. It’s a milestone that signals not just innovation for one company, but a new era for the broader housing finance industry. David Bleznak, former Founder of Totle and one of our current General Partners on our DGB team describes his experience working with LitFinancial and what this means below.